cheap stocks

#71

Registered

iTrader: (1)

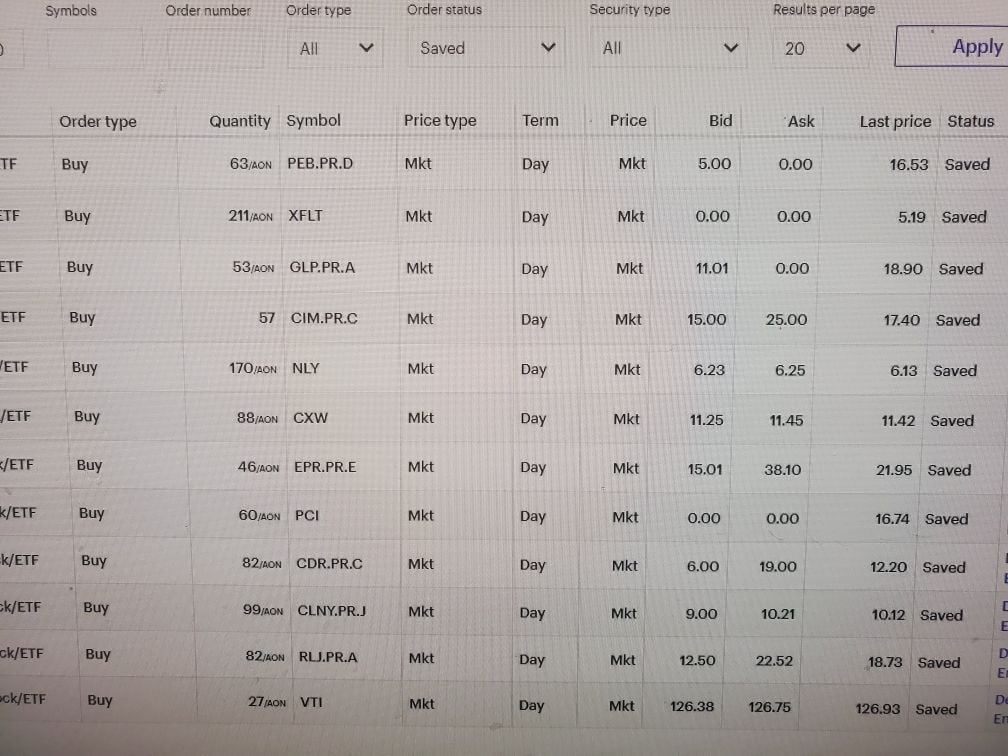

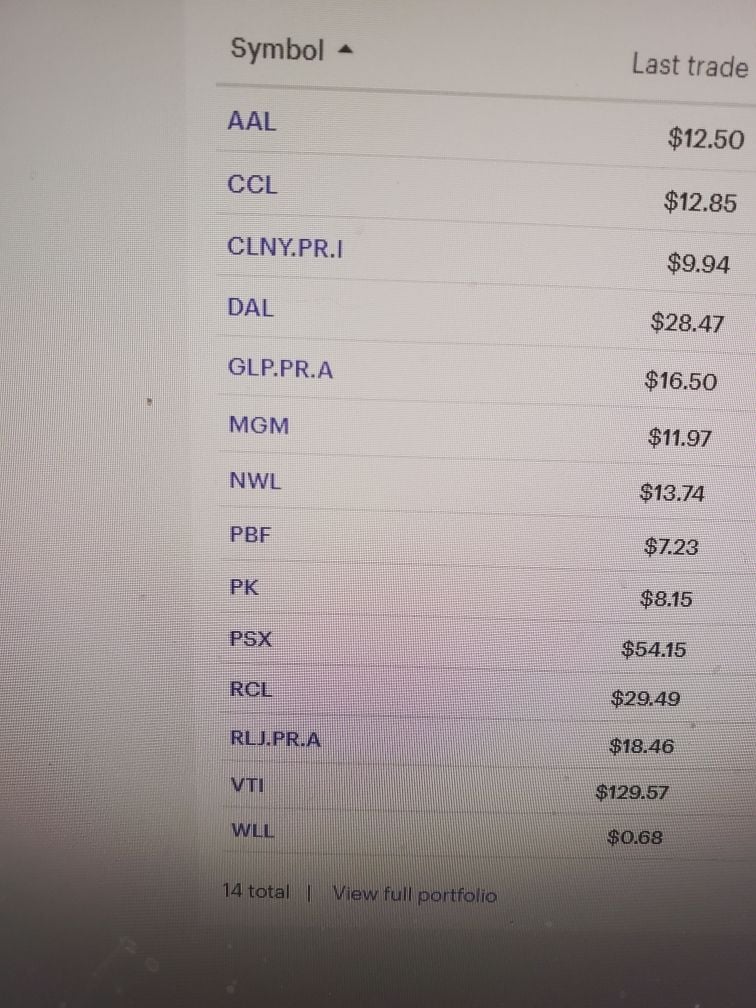

These are the soldiers I have sent into battle. My opinion is we hit bottom on the 18th and 19th but just incase I`m wrong still holding back some soldiers in reserve.

REIT`s / preferred stocks have from 10%-19% dividends you can pick those up pretty cheap right now and enjoy the payouts and hope they refinance the debt , the regular stocks for me are a short term hold till they come back up .. If you check out the 5 year history on those it`s a steal.

picked up MGM@$9.85

Royal Carrib @ $22.89

Delta @ $22. (buffet bought 12% recently)

RLJ.PRA@ $11.66

PBF oil @$ 6.34

My credit union has Corona personal loans, no payments for 90 days , got some of their soldiers in the fight too. Nothing ventured nothing gained I guess.

Last edited by ICDEDPPL; 03-31-2020 at 10:42 AM.

#72

Registered

Crushed it on cruise lines today...shorted Norwegian and RCL...made a quick 20% on both of them.

bought utx and Disney on March 23...both in the 70 and 80ís picked up 15% on each.

looking at my next moves as I type...

bought utx and Disney on March 23...both in the 70 and 80ís picked up 15% on each.

looking at my next moves as I type...

#73

Registered

Thread Starter

My father always told me the old saying of never try and catch a falling knife. He was always more conservative than me. The market is gambling IMO.

#74

Registered

I was on a conference recently with Kevin O'Leary and several wealth managers...All of them were advocating buying in gradually during this downturn. Kevin especially was extremely aggressive, saying he has stopped most of his treasury investments and is transferring to securities. Bonds are uninteresting to him. He is moving to a more aggressive 70/30 or even 80/20 securities/treasuries allocation and expects the return to be very strong within the next 2 years or less. He gave 3 outlooks. Best case, worst case, and middle ground. Worst case was this goes until December and recovers then.

If you sit on the sidelines you'll lose nothing and also gain nothing. If you have some laying around, get in on some quality companies. My personal wealth advisor said this is the best buying opportunity he's seen in his lifetime. Many reasons behind all of this.

If you sit on the sidelines you'll lose nothing and also gain nothing. If you have some laying around, get in on some quality companies. My personal wealth advisor said this is the best buying opportunity he's seen in his lifetime. Many reasons behind all of this.

#76

Registered

Same for 1987. If 87 and 08 repeat, we have a few more dips to go through before steady upturn resumes. Agree buying in steadily over upcoming months will be your friend.

#77

Registered

Sure, the same thing was said in 87, 2008, etc. and were they wrong? Nope. Those who bought at the lows gradually during those times made the most money (obviously). This will be no different.

#79

Registered

My opinion...this is an ideal market to short trade stocks. There really is no downside especially if itís money you can afford to sit on for 1-2 years. Itís not a question of if you will make money, but a when will you make money.

predicting the bottom is impossible...no one knows. I think too many people get caught up in that mentality. But as mentioned above, you canít make money if you donít have any money in the pot. Too many stand on the sidelines as the stocks go up. Itís worse to buy a surging stock than catch a falling knife.

just my opinions.

predicting the bottom is impossible...no one knows. I think too many people get caught up in that mentality. But as mentioned above, you canít make money if you donít have any money in the pot. Too many stand on the sidelines as the stocks go up. Itís worse to buy a surging stock than catch a falling knife.

just my opinions.

#80

Registered

Below is a volume profile chart for S&P 500 (June) futures. Futures numbers will vary a bit from cash market. The high volume nodes (spikes on right) are areas where the market experienced acceptance of previous pricing levels and may behave like magnets or areas of interest.

We paused just south of the 2018 lows at the 2281 HVN (high volume node) on 3-10 and then visited and turned at the 2175 HVN (near pink line). 2050 is the next major area below (curser at 2047.50). Goldman called for S&P 2000 in recent Barron's issue prior to any rally in 3Q. Obviously no one knows for sure...

Anyway some areas to think about- I don't have any data lower... apologies for the photo quality.

Stay safe!

We paused just south of the 2018 lows at the 2281 HVN (high volume node) on 3-10 and then visited and turned at the 2175 HVN (near pink line). 2050 is the next major area below (curser at 2047.50). Goldman called for S&P 2000 in recent Barron's issue prior to any rally in 3Q. Obviously no one knows for sure...

Anyway some areas to think about- I don't have any data lower... apologies for the photo quality.

Stay safe!

Last edited by 28 V; 04-01-2020 at 11:31 PM. Reason: clarity