cheap stocks

#341

Registered

#342

Registered

iTrader: (1)

I`m the tortoise not the hare chasing fast gains, here`s another 10% dividend stock tortoise style.

Note: XFLT goes ex-dividend on Feb 16.

Summary

Sometimes to be a successful investor, especially when seeking out income, you need to be diligent and learn. One sector that often generates lots of confusion (and fear) is when it comes to investing in CLOs (Collateralized Loan Obligations). As income investors, we like to have an allocation of our portfolio to CLOs. A small exposure can go a long way in boosting your income, without increasing the volatility of a portfolio too much.

Today, the CLO sector remains undervalued relative to other high yield sectors. This is also a cyclical sector that is set to greatly benefit from a U.S. economic recovery.

10.6% Monthly-Pay, High Insider Ownership: XFLT

Today we are updating on a monthly-pay CEF that we hold in our Model Portfolio. The CEF is XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) which yields 10.6%. XFLT offers a great way to bank on the recovery of the U.S. economy with high yields. It has some exposure to CLOs that are seeing their prices going up quickly as evidenced by the recent earnings report of Oxford Lane (OXLC). The fund benefits high insider ownership with insiders owning 8.3% of their own stock. The dividend is paid monthly, another added value. Below is our full report on why XFLT is a strong buy.Note: XFLT goes ex-dividend on Feb 16.

Summary

- CLOs and Senior Secured Loan provide a great way to bank on a rebounding economy.

- We are highlighting XFLT, a compelling way to get solid income.

- This is a monthly-pay CEF with 10.6% yield.

- Great outlook and high insider ownership.

- Buy for the income, enjoy the NAV run.

Sometimes to be a successful investor, especially when seeking out income, you need to be diligent and learn. One sector that often generates lots of confusion (and fear) is when it comes to investing in CLOs (Collateralized Loan Obligations). As income investors, we like to have an allocation of our portfolio to CLOs. A small exposure can go a long way in boosting your income, without increasing the volatility of a portfolio too much.

Today, the CLO sector remains undervalued relative to other high yield sectors. This is also a cyclical sector that is set to greatly benefit from a U.S. economic recovery.

#343

Registered

iTrader: (1)

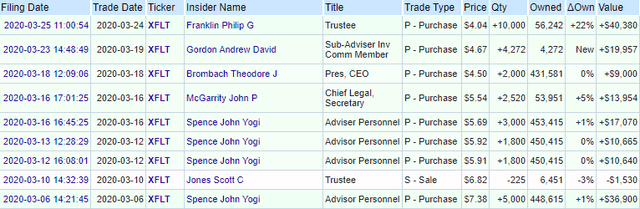

High Insider Ownership

In the past 12 months, there has been high level of insider buying, including the CEO, advisers, and trustees, which was mostly done during the March crash. What is good to note is that there has been no insider selling during all of 2020 and to-date in 2021. This lack of sales coupled with some buying indicates that the management sees upside potential and is confident about the future of the company.

Source: OpenInsider

Importantly, today these insiders currently own 8.3% of XFLT's total shares. This is very a large ownership and provides us with great confidence for the outlook of the company. It is also an indication that the management is likely to be aligned with the interest of shareholders. I like it when management have skin in the game!

Conclusion

As the vaccine reaches the masses, this will unleash a synchronous recovery not seen in years. I like those companies that are leveraged to an economic recovery and selling at a discount to intrinsic value. XFLT is one of my recommendations.XFLT is seeing a strong uptrend in both NAV rising and in its market price. As CLOs continue to rise across all CLO funds, XFLT provides a more conservative approach to gain exposure to this sector and boost your income. With its exposure to Senior Secured Loans, it provides a stabilizing base to their portfolio. XFLT has a firm foundation from which to move forward.

The company has high insider ownership of 8.3% that inspire confidence about the future of their overall portfolio. I am happy to hold alongside them. XFLT offers a great way to bank on the recovery of the U.S. economy with high yields, and deserves strong consideration for a part of your income portfolio. Another big plus is that the 10.6% yield is monthly-pay. I love this feature as I do not have to wait 3 months to collect my paycheck.

#344

Registered

Hopefully the folks in tilray/sundial etc got out yesterday...

#345

Registered

The following 2 users liked this post by TrippM:

OldSchool (02-11-2021), PartyBarge22 (02-11-2021)

#346

VIP Member

I'm in Tilray @ $6.50 a share. It's simply entertainment at this point!

As usual with the market BS lately, stupid people get caught up in the hype and are left holding their crotch without their money!

As usual with the market BS lately, stupid people get caught up in the hype and are left holding their crotch without their money!

__________________

Happily retired and living in Heavens waiting room.

Happily retired and living in Heavens waiting room.

The following users liked this post:

TrippM (02-11-2021)

#347

Registered

Sold all 9200 shares of SNDL yesterday afternoon and then kicked myself when it jumped after hours. Happy about my decision now.

Thinking about buying more Draft Kings to hold long term.

Thinking about buying more Draft Kings to hold long term.

#350

Registered

Even without the US the euro deal is enough to ensure growth.

Even without the US the euro deal is enough to ensure growth.Cheers