Gladiator price hike!!

#91

Registered

"Michigan repossession laws allow the lender to collect the remaining difference from you if the auction price of the repossessed car or truck did not cover the full balance of the loan. This could include RV repossession, Motorcycle repossession, ATV repossession, Boat repossession, or even Airplane repossession in Michigan."

I ended up paying off a house I no longer owned--but that was long ago. YMMV in other states.

I ended up paying off a house I no longer owned--but that was long ago. YMMV in other states.

#92

I hate when people come on here and spout off about how you should only pay cash for toys.

i financed part of both my cigs (as have most on here). I sleep pretty well at night - there is nothing wrong with borrowing. Frankly, people that are able to afford 3, 4, 500k boats are probably smart enough not to pay cash.

If you sleep better at night paying cash, great, but if I had 150k in cash lying around I'd buy another rental house and use the 1,500/month in rent to easily cover the boat payment......

i financed part of both my cigs (as have most on here). I sleep pretty well at night - there is nothing wrong with borrowing. Frankly, people that are able to afford 3, 4, 500k boats are probably smart enough not to pay cash.

If you sleep better at night paying cash, great, but if I had 150k in cash lying around I'd buy another rental house and use the 1,500/month in rent to easily cover the boat payment......

#93

Gold Member

I think the point is being missed here. I believe what was trying to be related was this. When you buy a brand new boat you know your going to take a big depreciation hit more than likely over 100k. So if you can’t pay for a 300k boat cash and take the depreciation hit then most likely need to get into a cheaper boat where the depreciation hit won’t be as big and won’t financially hurt you. Again nothing wrong with not being able to afford a 300k boat. But I think people get into a lot of trouble when they finance the 300k boat just because they can “make the payment”. Then when it’s time to sell they are completely upside down on the boat and can never make up the difference. Where as the people paying for those toys cash the depreciation hit probably doesn’t affect them as if they can afford to pay that kind of money cash they probably have a lot more than that.

No, I understand the point - exactly why I put enough down on my boats that I can never be upside down. And I wasn't trying to be snotty with 1960, but everyone's financial position and approach is different and financing is okay.....

#94

VIP Member

not to mention many boat loans can be written off as a second home or second mortgage depending on loan source.

#97

Registered

As stated above in most states the bank can sue you for the balance between what the item sold for at auction and the balance of loan. On the flip side if you pay cash it doesn't really matter if the economy goes south because you already own it outright. A boat loan is like a mortgage and the interest is a killer so if you have the $$ I agree it's better to pay it off.

#98

Registered

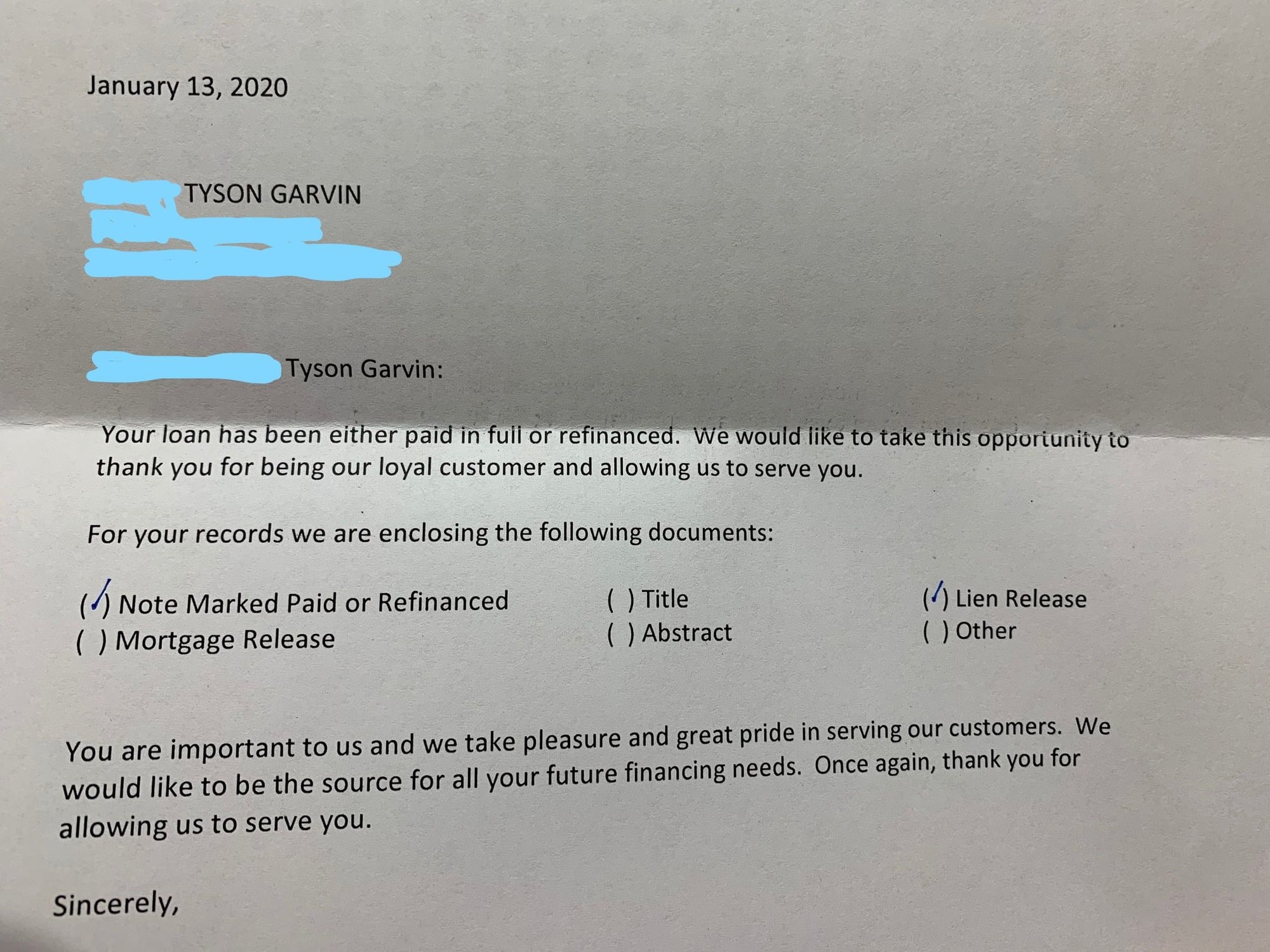

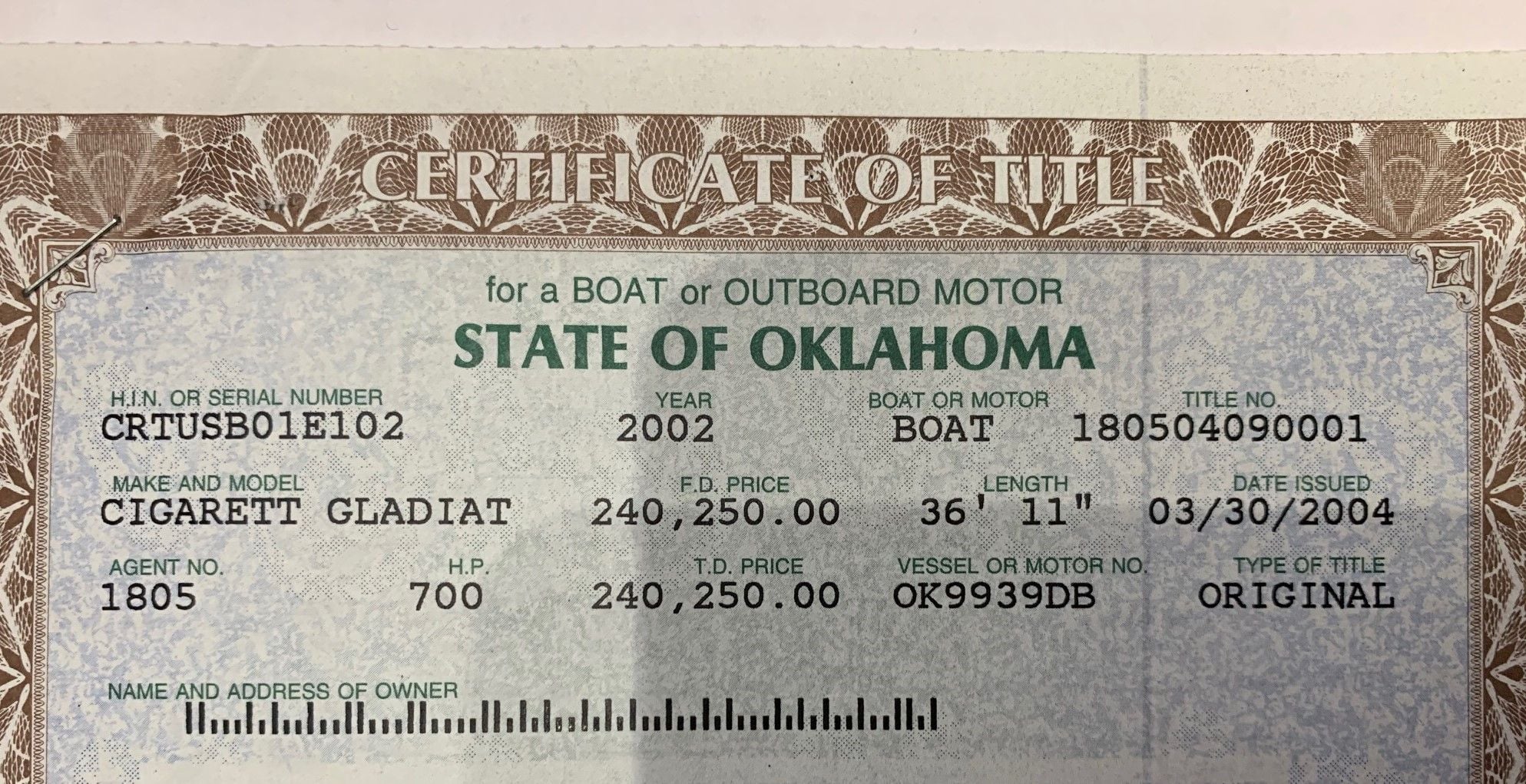

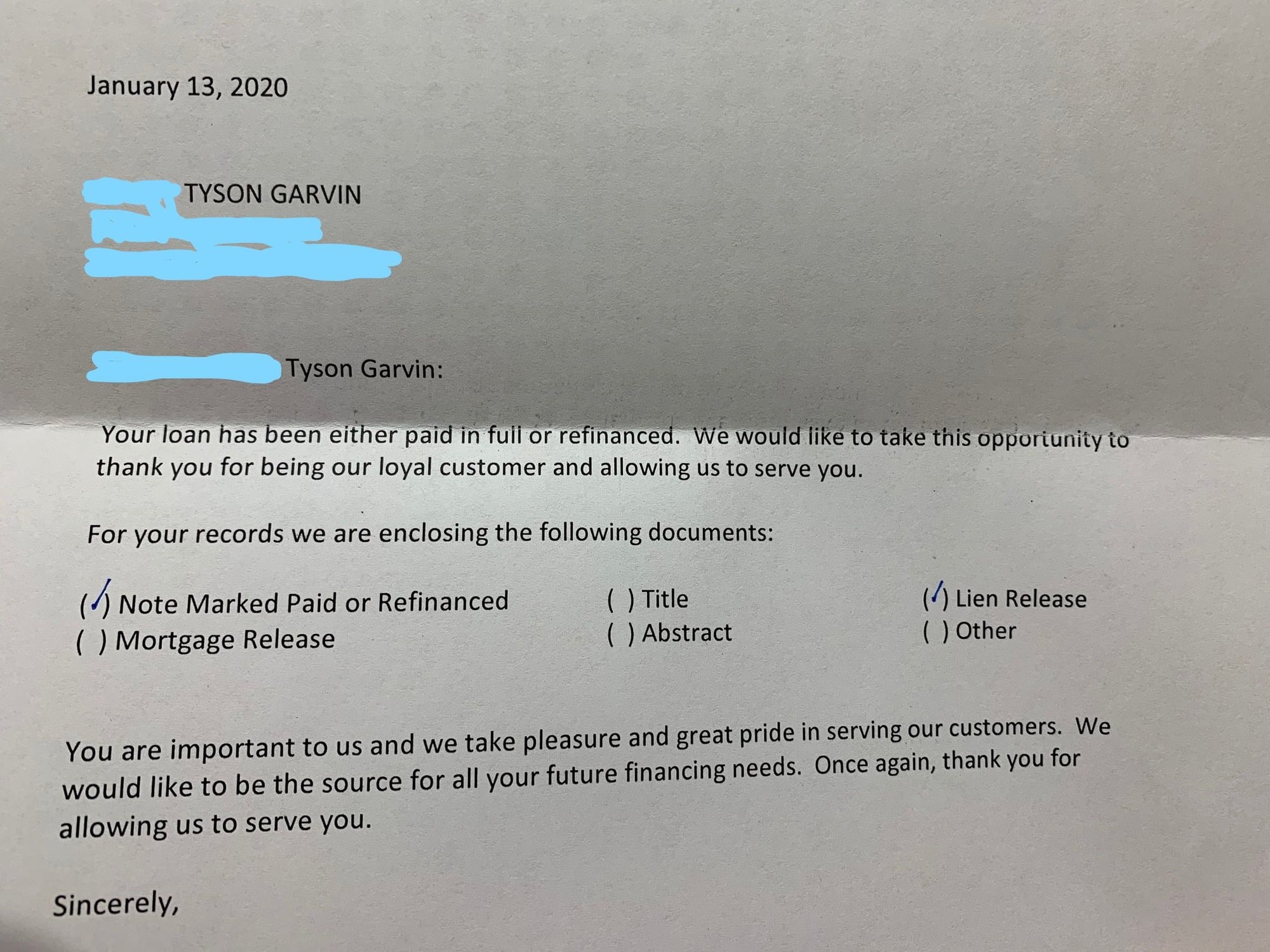

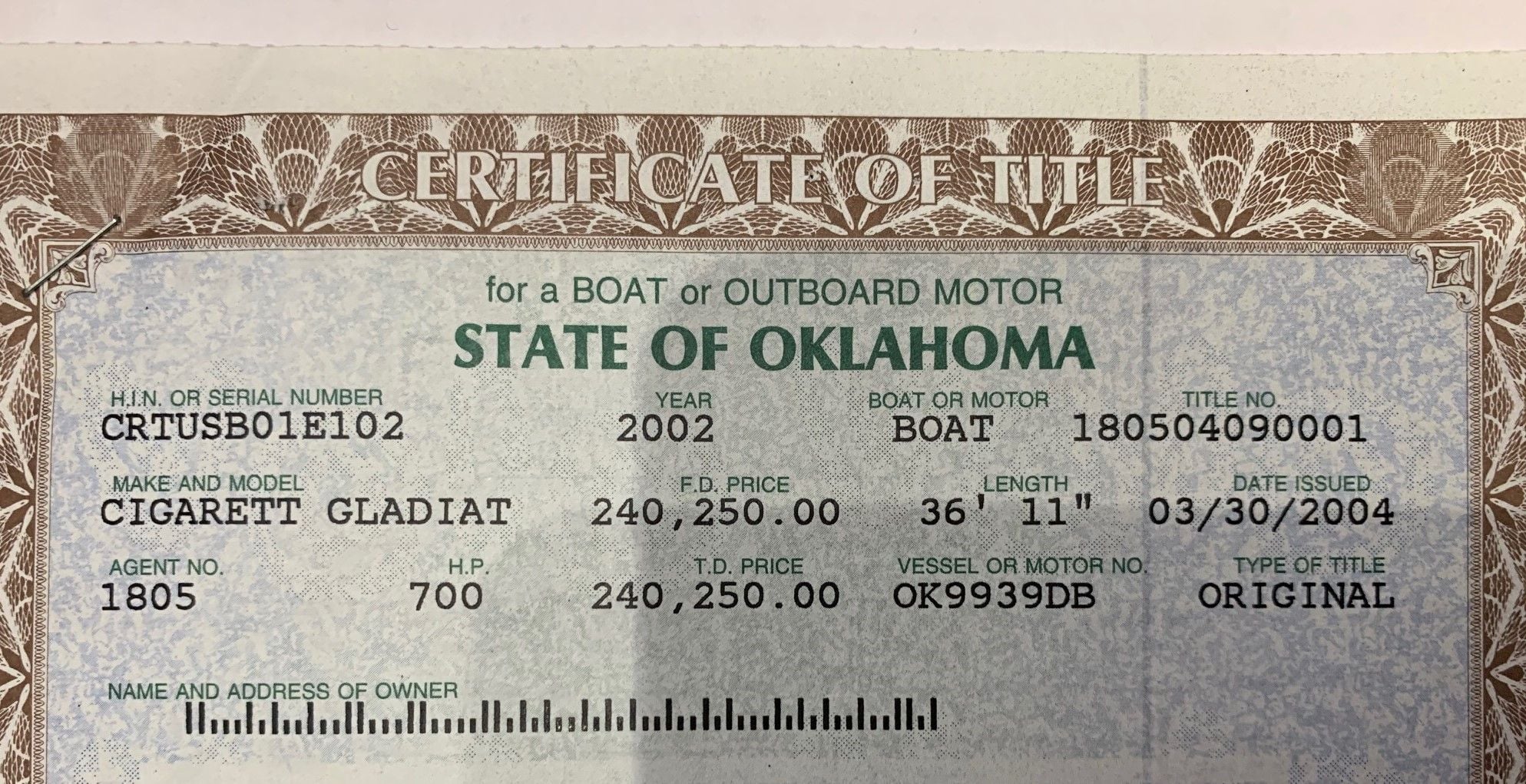

Since were on the subject of Gladiators, and financing, loans, ect. My last payment on the Gladiator Was last month. I had a cheep interest rate so I felt it was better to keep making payments instead of paying it off when I made chunks of money.

Last edited by BigSilverCat; 02-03-2020 at 05:43 PM.

#99

VIP Member

As stated above in most states the bank can sue you for the balance between what the item sold for at auction and the balance of loan. On the flip side if you pay cash it doesn't really matter if the economy goes south because you already own it outright. A boat loan is like a mortgage and the interest is a killer so if you have the $$ I agree it's better to pay it off.

#100

Registered

Stay on target, stay on target... gladiators are bad ass boats and relative to what other models are getting... probably deserve the money they’re asking imo. When the economy is good everything goes up.